Medical Evacuation: What It Is & Why Every Traveler Needs Coverage

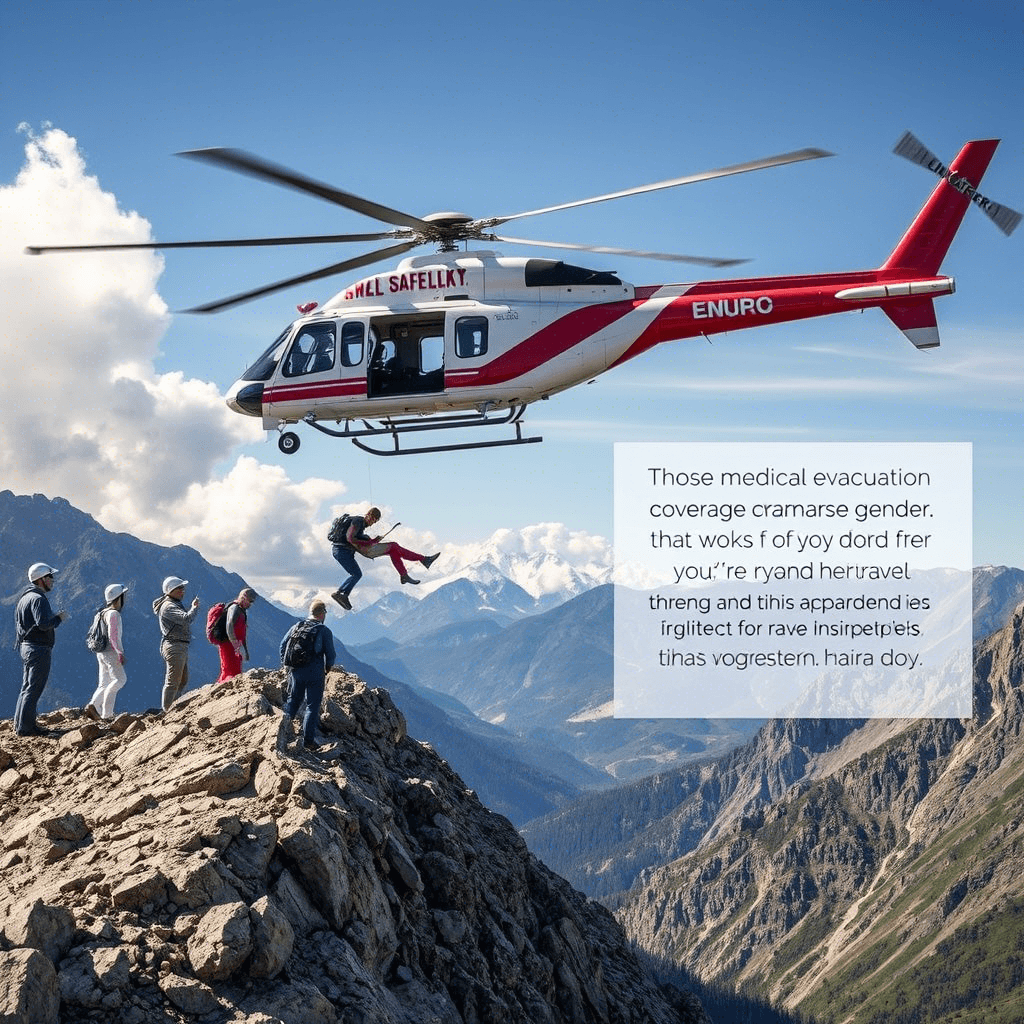

Traveling is exciting. Whether you’re exploring a remote island in Bali or hiking the Andes, adventure awaits. But what happens if you fall seriously ill or get injured in a place where medical care is limited?

That’s where medical evacuation comes in — a critical feature of travel insurance that can save your life and your wallet. In this guide, we’ll break down what medical evacuation is, how it works, and why it’s one of the most important coverages you can have.

What Is Medical Evacuation?

Medical evacuation, often abbreviated as medevac , refers to the emergency transport of a traveler from their current location to a facility where they can receive appropriate medical care.

This can involve:

- Air ambulance flights

- Ground ambulance services

- Emergency medical transport by helicopter

- Repatriation back to your home country

Medevac is typically arranged by your travel insurance provider when your health condition requires urgent and advanced care that’s not available locally.

Why Medical Evacuation Coverage Matters

Imagine being in a remote location with limited access to hospitals, specialists, or even basic diagnostics. In such cases, getting timely medical help can be a matter of life or death.

Without proper medical evacuation coverage, you could face:

- Sky-high out-of-pocket costs (air ambulance can cost tens of thousands of dollars)

- Delayed treatment

- Risk of complications or even death

Medical evacuation coverage ensures that you’re not only transported safely but also receive the right level of care when you need it most.

How Does Medical Evacuation Work?

Here’s a step-by-step breakdown of how the process typically works:

- Emergency Occurs – You suffer a serious illness or injury while traveling.

- Contact Your Insurer – Notify your travel insurance provider immediately via their 24/7 emergency hotline.

- Medical Evaluation – A team of medical professionals assesses your condition and determines if evacuation is necessary.

- Transport Arranged – If approved, your insurer arranges the most suitable mode of transport — usually an air ambulance staffed with medical personnel.

- Medical Facility Transfer – You are flown to the nearest appropriate medical facility, or repatriated home if needed.

- Coverage Applies – Your travel insurance policy covers the cost of the evacuation, as long as it’s within the policy terms.

When Is Medical Evacuation Necessary?

Not every illness or injury will require a medical evacuation, but here are some common scenarios where it becomes essential:

- Severe trauma from an accident

- Heart attack or stroke

- Serious illness requiring surgery

- Complications during pregnancy

- Infections requiring specialized treatment

- Broken bones in remote locations with no orthopedic care

- Psychiatric emergencies needing stabilization

If your current location can’t provide adequate care and time is of the essence, medical evacuation becomes the only viable option.

Real-Life Example: A Medevac Scenario

Let’s say you’re trekking in Nepal and suffer a severe altitude sickness complication known as High Altitude Pulmonary Edema (HAPE). You’re in a remote mountain village with no hospital nearby.

You call your travel insurance provider’s emergency number. After a quick evaluation, they decide you need to be flown to Kathmandu or even back to your home country for treatment.

Your insurer arranges a helicopter medevac, and you’re transported safely. All the costs — from the helicopter flight to the medical crew — are covered by your travel insurance policy.

Without that coverage, you could have been looking at a $50,000+ bill — or worse, no evacuation at all.

Medical Evacuation vs. Travel Insurance: What’s the Difference?

While travel insurance is a broad term that includes various protections like trip cancellation, lost luggage, and medical coverage, medical evacuation is a specific benefit within that package.

Here’s a simple comparison:

| Covers trip cancellation | ✅ | ❌ |

| Covers lost baggage | ✅ | ❌ |

| Covers medical treatment | ✅ | ✅ |

| Covers emergency transport | ❌ | ✅ |

| Emergency assistance | ✅ | ✅ |

Key Takeaway: Not all travel insurance policies include medical evacuation as a standard benefit. Always read the fine print.

What Does Medical Evacuation Cover?

A comprehensive medical evacuation clause in your travel insurance policy should cover:

- Emergency air or ground ambulance services

- Medical personnel during transport

- Stabilization care before evacuation

- Coordination and logistics of the evacuation

- Transport to the nearest appropriate facility

- Repatriation of remains (in case of death)

Some policies may also cover a travel companion to accompany you during the evacuation, especially if you’re a minor or incapacitated.

What Isn’t Covered by Medical Evacuation?

Like any insurance, medical evacuation has limitations. Here are some common exclusions:

- Pre-existing conditions (unless specifically covered)

- Non-emergency medical transport

- Elective or cosmetic procedures

- Travel against medical advice

- Injuries from extreme sports (unless added as an optional rider)

- Self-inflicted injuries or intoxication-related incidents

Always review your policy details to understand what’s included and what isn’t.

How Much Does Medical Evacuation Cost Without Insurance?

If you don’t have coverage and need to arrange a medical evacuation on your own, the costs can be staggering.

Here’s a rough breakdown:

| Domestic ground ambulance | $500–$2,000 |

| International air ambulance | $10,000–$100,000+ |

| Helicopter evacuation | $15,000–$50,000 |

| Repatriation flight | $20,000–$75,000 |

These costs can vary depending on location, distance, and complexity of care.

How to Choose a Travel Insurance Policy with Medical Evacuation

Not all policies are created equal. Here’s how to ensure you get the right coverage:

✅ Check for Medical Evacuation as a Standard Benefit

Some insurers include it by default. Others offer it as an optional add-on.

✅ Look at the Maximum Coverage Limit

Make sure the policy covers at least $1 million in medical evacuation expenses.

✅ Verify the Emergency Assistance Network

A reliable insurer will have a 24/7 assistance team and a global network of medical providers.

✅ Read the Exclusions Carefully

Know what’s not covered — especially if you have pre-existing conditions or plan to engage in adventure sports.

✅ Compare Multiple Providers

Use a comparison tool to evaluate coverage, cost, and customer reviews.

Top Travel Insurance Providers with Medical Evacuation Coverage

Here are some top-rated insurers that include medical evacuation in their policies:

| World Nomads | Up to $300,000 | Adventure sports coverage, 24/7 emergency support |

| Allianz Travel Insurance | Up to $1 million | Trip cancellation, baggage loss, and medical coverage |

| SafetyWing | Up to $250,000 | Budget-friendly, ideal for digital nomads |

| Travelex Insurance | Up to $500,000 | Customizable plans, includes evacuation |

| Seven Corners | Up to $1 million | Strong reputation for medical assistance and evacuation |

Always verify the policy details before purchasing.

How to File a Medical Evacuation Claim

If you ever need to use your medical evacuation coverage, follow these steps:

- Notify Your Insurer Immediately – Use the 24/7 emergency number provided in your policy documents.

- Provide Medical Documentation – Share your diagnosis, current treatment, and doctor’s recommendation.

- Let the Insurer Coordinate the Evacuation – Do not arrange transport on your own — it may not be covered.

- Keep All Receipts and Records – Even if you’re unconscious, your travel companion should document everything.

- Submit the Claim After the Incident – Most insurers will handle the costs directly, but always follow up to ensure proper processing.

Tips to Maximize Your Medical Evacuation Coverage

- Read your policy thoroughly before traveling

- Save the emergency number in your phone and print a copy

- Carry a copy of your policy with you

- Inform your insurer if you have pre-existing conditions

- Avoid risky behavior that could void your coverage

Frequently Asked Questions

What is medical evacuation in travel insurance?

Medical evacuation in travel insurance refers to the emergency transportation of a traveler to a medical facility where they can receive appropriate care, often involving air ambulance services or repatriation.

Is medical evacuation covered by all travel insurance policies?

No, not all policies include medical evacuation as a standard benefit. Some offer it as an optional add-on, so it’s important to check your policy details.

How much does medical evacuation coverage cost?

Medical evacuation coverage is usually included in the base price of a comprehensive travel insurance policy. Standalone medevac services can cost $100–$500 annually, depending on coverage limits.

Can I get medical evacuation without travel insurance?

Yes, but it can be extremely expensive. Private medical evacuation services charge tens of thousands of dollars, which is why having travel insurance with this coverage is highly recommended.

Does medical evacuation cover family members?

Some policies allow for a travel companion to accompany you during evacuation, especially if you’re a minor or require assistance. Always check your policy for details.

Final Thoughts: Don’t Travel Without Medical Evacuation Coverage

Medical emergencies can happen to anyone, anywhere. Whether you’re backpacking through Southeast Asia or island-hopping in the Mediterranean, having medical evacuation coverage is a lifeline — both literally and financially.

Before your next trip, take the time to compare policies, understand what’s covered, and make sure medical evacuation is included.

Ready to Get Covered?

🔍 Compare Policies | 📄 Download Our Free Checklist | 💬 Ask Us a Question